| Welcome to your weekly newsletter, part of a new partnership between the Financial Times and Infosys that combines world-class journalism with cutting-edge technology expertise. Every week, we will bring you insights on geopolitics, technology, macroeconomic trends, leadership, and corporate governance - everything board directors need to know to stay ahead. If you have comments, suggestions or news you think we should include, email me at andrew.hill@ft.com or newsletter editor Jonathan Moules at jonathan.moules@ft.com. This week, we look at the pros and cons of co-CEOs, the shockwaves from Donald Trump’s new fee on H-1B visas and the relentless leadership style of one of the UK’s top chief executives. Thanks for reading. When two heads might be better than one

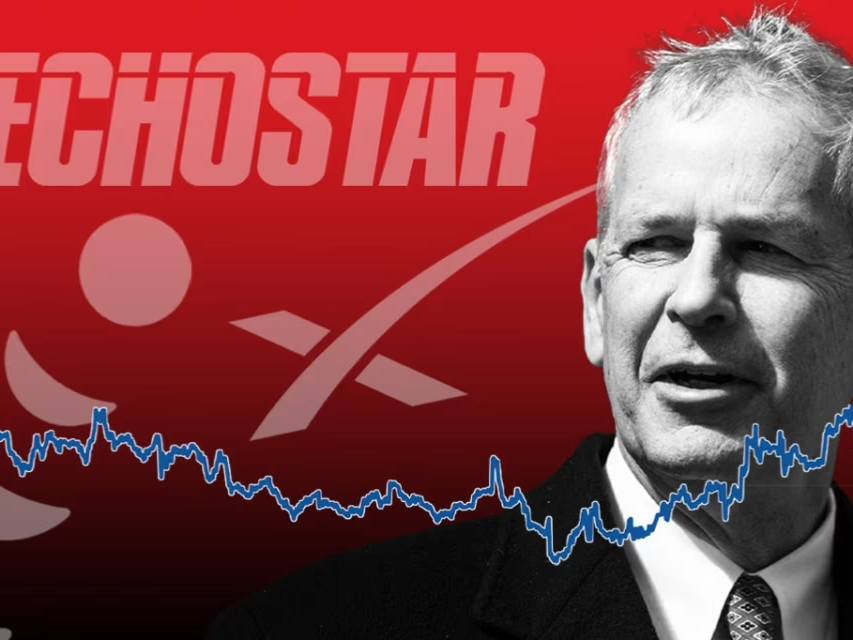

Clay Magouyrk, who is set to become Oracle’s co-chief executive, alongside Mike Sicilia © REUTERS The question of how much power to vest in a chief executive and how much to delegate is critical. Most boards opt for a single CEO. In Europe, he or she is often paired with and overseen by a separate chair; in the US, the chair role is still frequently (though not as frequently as it used to be) gifted to a successful chief executive. But there is no one-size-fits-all solution to this important governance challenge. Oracle this week announced Safra Catz would stand down as the tech company’s chief executive and the role would be split between her successors. I’m no fan of co-CEOs. Too often, boards appoint them because they cannot or will not adjudicate on a power struggle. Eventually, one of the duo is forced out. But Oracle has been here before. Catz was co-CEO from 2014 to 2019 with Mark Hurd. A form of power-sharing is built into the idiosyncratic structure of the company, where founder Larry Ellison is a dominant, quasi-executive chair. Whatever anyone thinks about the leadership model, few can argue with the sort of success Ellison, Catz and Oracle have enjoyed. Double-bossing has its fans. Laura Empson, a professor at Bayes Business School, has found that “leadership dyads” can work well in professional partnerships such as law firms. The arrangement “embodies and resolves the inherent conflict between the interests of individual partners and of the partnership as a collective”. Of course, the reverse — a single over-mighty chief executive — can be just as bad as a feuding duo. Coincidentally, that problem resurfaced at Porsche this week. Following profit warnings at the German fast-car maker, Oliver Blume, who also heads Volkswagen, faces renewed pressure to give up one of his two chief executive roles. Blume has in the past said his double-duty, which began in 2022, was “not designed for eternity”. For shareholders, however, Blume’s reluctance to share power means three years is starting to feel like a very long time. Artificial intelligence is the hot topic of conversation in the boardrooms of the world’s largest companies, according to a Financial Times analysis of hundreds of corporate filings and executive transcripts at S&P 500 companies last year, providing one of the most comprehensive insights yet into how the AI wave is rippling through American industry. But little of the talk is about the positives of the fast evolving technology. Indeed as the number of companies discussing AI has grown, fewer businesses are expressing positive views about the technology than they did in 2022. Cyber security is the most commonly expressed concern, mentioned as a risk by more than half of the S&P 500 in 2024.  | How a deal with Elon Musk helped a telecoms tycoon save his company from bankruptcy | | Billionaire Charlie Ergen struck deals with bondholders and rivals to trade his empire out of trouble. But at what cost? |

|  | Trump attack on specialist visa hits its biggest beneficiaries: tech titans | | Silicon Valley bosses, many of whom used the H-1B visa themselves, are alarmed about new $100,000 application fee. |

|  | Aviva boss Amanda Blanc: ‘The word relentless will have been used about me’ | | The head of the UK insurer has taken a bold approach to restructuring but must now deliver further growth. |

|  | How top hedge funds can pay traders $100mn | | The era of giant multi-managers has changed how rewards are calculated — and ushered in bumper deals. |

|

| | |

Best from elsewhereArtificial Intelligence in the Boardroom Artificial intelligence adoption by the board mitigates some of the negative aspects of the CEO’s AI use, but cannot restore efficient levels of board monitoring. This research assessed how the use of AI affects the monitoring and advisory relationship between CEOs and corporate boards. It suggests that the adoption of AI in the boardroom may have unintended consequences for corporate governance. 2025 private company board survey insights | KPMG Two years ago, nearly two-thirds of directors told KPMG that the greatest opportunity for improvement in board oversight was in strategy. This update to that survey takes a closer look at the challenges boards face in oversight of strategy and where they can add the most value, including the impact of GenAI on the strategic planning and where the board now adds value. Ethnic Representation in New Russell 3000 Director Appointments Has Fallen 22% Since 2022 This research examines whether recent political and regulatory developments have affected the trajectory of board diversity. It found that a major contributor to the decline in ethnic diversity has come from less Black/African American and Hispanic/Latino representation.

Board Network is written by Andrew Hill and Jonathan Moules |